How passive can direct ownership of rental real estate really be??

May 06, 2021Last year I was doing a rehab on a local rental property I had just acquired, while working full time as a Radiologist and raising two kids under 6. I chose not to use a General Contractor for many reasons. While I was sourcing materials for the rehab and managing the crews, I also acquired three out of state rentals.

My best friend was genuinely concerned that I was over exerting myself and asked me to slow down on the acquisitions. That's when it struck me that most people would be surprised by how much time it actually took me to acquire one out-of-state property using the systems I had in place... I suggest you take a quick guess before I dive into this...

Background

For those of you who are new to the blog, I am a physician living and working in beautiful, sunny California - but I predominantly invest out of state in Texas. Why Texas you may ask? What's not to love about Texas -

- Land lord friendly

- Great Cash flow

- Strong market for appreciation and increasing rents given the recent migration patterns

I didn't really understand much of this when I started investing in Texas 8 years ago. But I did do one thing correctly - I picked a market where I had a great TEAM in place - a great investor agent who would also help manage the property going forward.

Some of my mentees like to use what they learn in my course to do their own research, pick a strong market and then form their teams on the ground. I however like to do things differently. I work backwards. Which is what I also recommend to everyone in my course. I have always picked a market based on whether or not I had a strong team in place on the ground - often times piggy backing on to other physician investors I trust who have worked with these teams for at least a few years and recommend them wholeheartedly.

The few times that I have worked with investor agents to whom I was introduced through more casual references - I have been burned. I just cannot emphasize enough the importance of a great Team.

I'm going to do a deep dive and break down how much time I spend on average on my out-of-state rentals from acquisition to maintenance. I hope this inspires you to set aside your limiting beliefs - which for many of us is the fact that we don't have the time to invest in real estate.

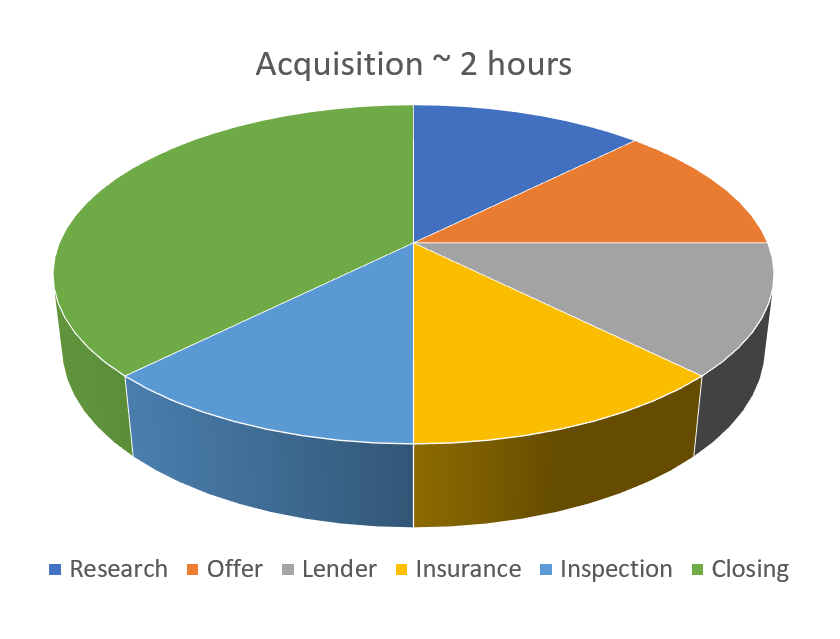

Acquisition: 2 hours spread out over 4 - 6 weeks

- Research - Most of the properties I end up purchasing have been deals my investor agent has brought to my attention - once she has vetted the deal. Having a great investor agent (one who works predominantly with investors) helps because they know about most of these listings even before they get listed. For a busy physician like me, that's usually 15 min of my time looking at the property, running numbers and making sure it meets my criteria. Once you know your sub market and have been investing there for a while, this part takes less and less time.

- Putting an offer in - Taking to my agent and Signing all the documents electronically - another 15 min.

- Lender - Since my lender is part of my team, my agent usually communicates with the lender directly to get a pre approval letter. It takes me 15 - 25 min to go over rates, options and documents my lender sends me. Since I am constantly working with my lender for cash out refinances, acquisitions etc I only need to send in one or two documents each time I need new financing.

- Insurance agent- My insurance agent is part of my team. She knows my preferences, I shoot her a quick email and we have a short 15 min conversation about the policy, additional insured etc. and we are all set

- Inspection - Since I have started acquiring newer properties - this is often a quick review of documents and then a quick conversation with my agent and the inspector. On average lets say this takes another 15 min including the time it takes me to pay the inspector.

- Closing - A mobile notary usually comes home with the closing documents that I need to sign - the closing documents are often sent to me ahead of time to review and on average the time it takes me to review these documents and sign them in the presence of the notary is around 45 min.

Leasing : 30 min - 1 hour

- I have to say that every time I lease the property out, it could take any where from 30 min to 1 hour to review multiple applications and sign the necessary documents. Again I rely heavily on my investor agent to screen applicants for me which reduces the time I spend on this process.

Maintenance : 3 - 5 hours over the year

- Unless I have major repairs involving insurance companies or home warranty, maintenance is usually negligible except for tax time when I have to get all my documents in order. And if you decide to outsource your book keeping - then that's less time spent doing this. The Class A- and Class B single family home Long Term Rental space in which I invest is a boring (in a good way), stable space with good tenants who usually have 2- 5 year tenancy. If you have good systems in place, your investment should be super passive.

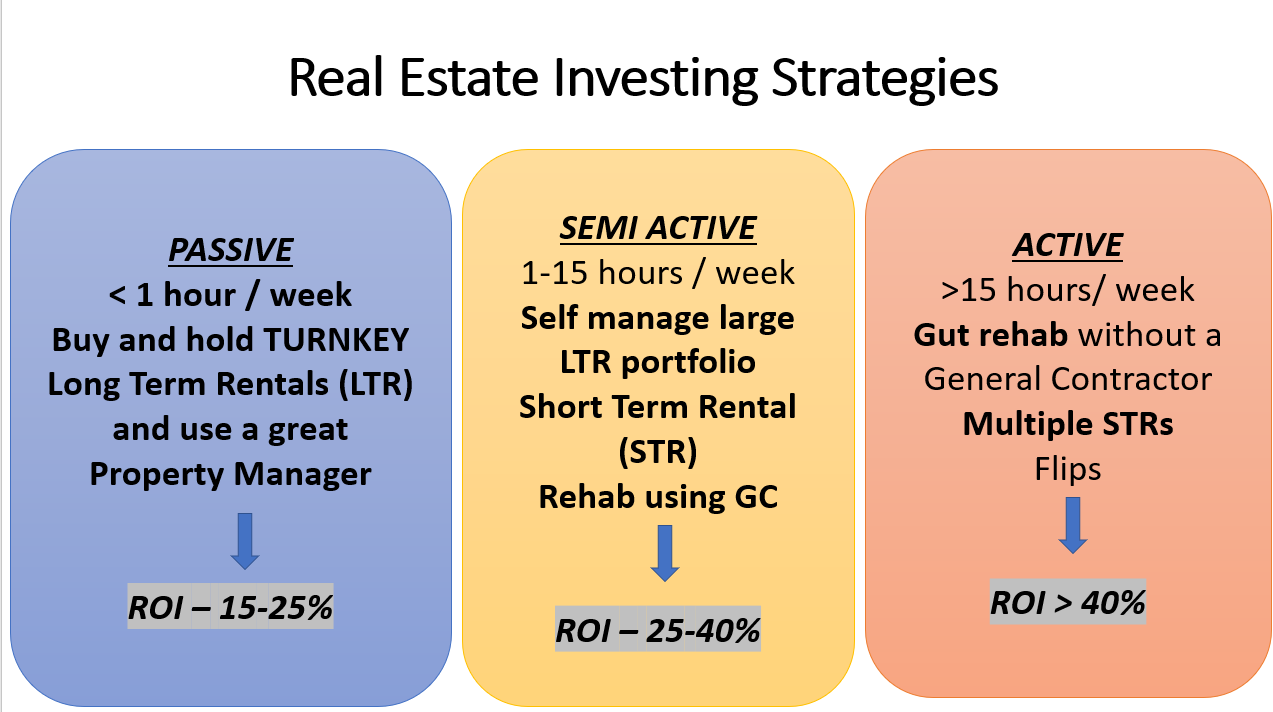

I also want to emphasize again that there are many ways to invest in real estate - ranging from super passive to super active. While your return on investment increases the more active you get, I wanted to remind the busy professionals out there that when done right - you can easily get mailbox money by investing in real estate.

Conclusion:

The tax code classifies owning Long Term rentals as a passive activity and I agree! Especially if you have efficient systems in place, you could be easily scaling your real estate portfolio while working a full time job and raising your kids giving them the time and attention they deserve.

While this may not be applicable to many people depending on how they invest and how their teams are set up, I would like to say that this is definitely possible if you choose that this super passive strategy is what works best for you given the demands on your time.

What I want you to take away from this blog post is that it is possible to work less than 2 hours a month on your real estate portfolio and generate even $10,000 a month in post tax dollars. Now tell me, how would that kind of financial freedom change your life??

Looking for Resources to help you Start or Scale your Real estate portfolio so you can hit Financial Independence faster?

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.